Investment Policy

CMFSC Investment Policy

I. General

The purpose of this Investment Policy ("the Policy") is to ensure that invested funds, together with future investment earnings and donations, are sufficient to meet the current and future needs of Coquitlam Metro-Ford Soccer Club ("CMFSC"), adjusted for inflation. In general, CMFSC's day-to-day operations do not depend on these funds, apart from operational contingency reserves. The Policy shall be reviewed annually by the Finance Committee/Board.

II. Quality of Investments

Investment of CMFSC assets will be made through Finance Committee/Board approved investment managers ("Investment Managers"). The assets will be invested in a manner which meets the generally accepted standards of quality that a prudent person would apply in investing the assets of another. The Investment Managers are expected to invest the assets with care, prudence, and diligence that a prudent investment professional would exercise in the investment of those assets.

The objective is to maximize total investment return through diversification, across a broad range of asset classes, while preserving capital in an endowment-like fashion. Risk and return will be gauged against limited operational needs for cash from investments and an extended time horizon (endowment).

The funds will be invested with the understanding that returns will vary depending on asset classes and may be subject to decrease in value depending on market conditions. Risk and return will vary depending on asset classes and purpose of the funds, of which there will be three:

III. CMFSC Investment Classes

A. Operational Contingency Reserves

Operational Contingency Reserves will be part of General Funds and will be expected to keep pace with inflation on an annual rolling average over a five-year period.

Quantification | 20% of annual operating budget (90 days) |

Liquidity/Availability | 90 days to 24 months |

Instruments | Cash/Equivalents (i.e., Term Deposits) Fixed income (i.e., GICs, money market funds) Investment Grade Bonds (appropriately rated Gov’t/Corp.) |

Risk Tolerance | Low to Moderate |

Return | Low to Moderate |

Benchmark | Inflation |

The Treasurer and Finance Committee, in consultation with the Investment Advisor, are responsible for recommending investments of Operational Contingency Reserves funds to the Board.

CMF also invests a portion of funds in highly liquid cashable assets held at financial institutions for terms not to exceed 90 days.

B. Endowments

Endowment funds are designated for capital developments/investments or to generate returns to fund special projects, such as scholarships, financial subsidies, player/official/coach pathways, and youth development programs. These funds will be distinct and separate from General Funds (operating).

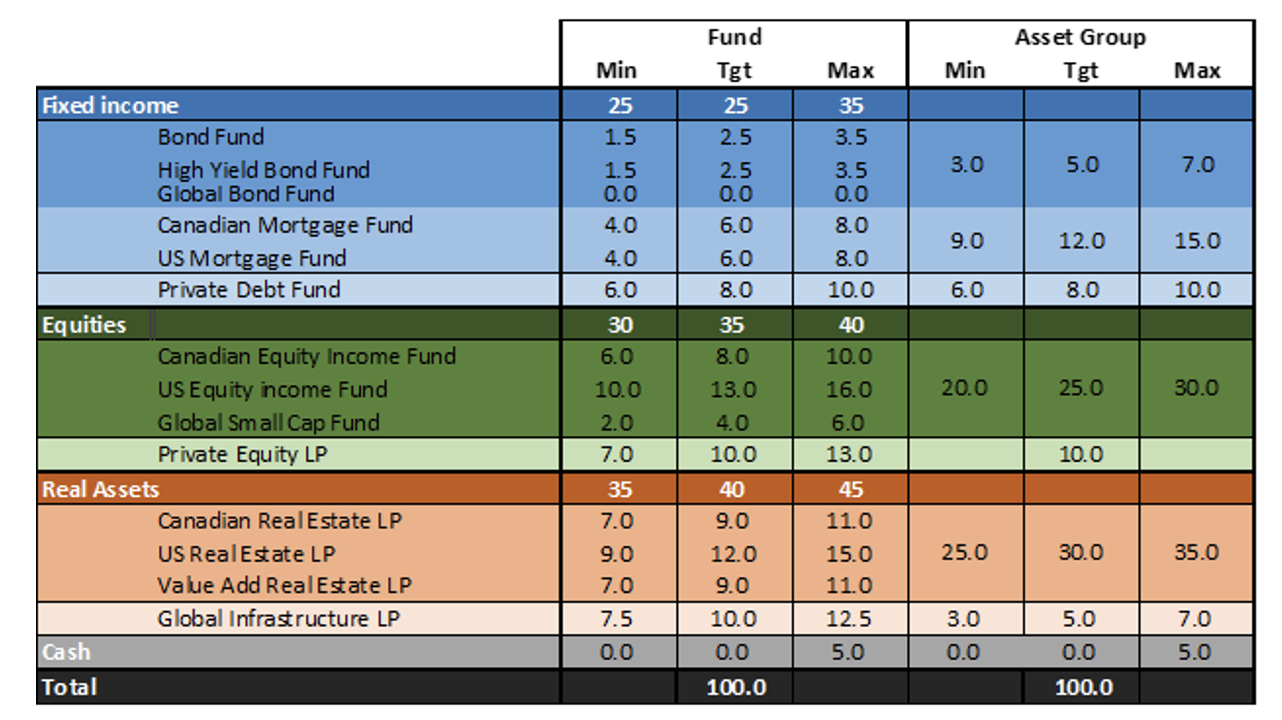

The asset allocation outlined in Appendix A specifies the target and allowable allocation across the asset classes.

As the projects contemplated to be funded from the endowment are long term in nature, the investments in the endowment can maintain a corresponding longer investment time horizon and accept short term volatility.

The Treasurer and Finance Committee, in consultation with the Investment Advisor, are responsible for recommending investments of Endowment funds to the Board.

C. Restricted/Donor Advised

Restricted/Donor Advised funds are significant, as defined by being greater than $250,000 and subject to the investment profile and direction of the donor or their designate. These funds will be distinct and separate from general and endowment funds. The donor may dictate a risk/return and asset allocation that differs from Endowment guidelines above. In some cases, these funds may possess a high risk and high growth profile.

IV. Permitted Asset Classes

The assets may be held in segregated accounts or invested in pooled funds and similar or alternative structures (e.g., limited partnerships) where CMFSC’s assets are commingled with other investors. Permitted asset classes include cash, short-term securities, Canadian and foreign bonds and debentures, asset-backed securities, infrastructure debt, mortgages, common stocks (including tradable income trust units and limited partnership units), American Depositary Receipts, Real Estate Funds, Infrastructure Funds, Private Debt Funds (including mortgage funds), Private Equity Funds and exchange-traded funds listed on a recognized stock exchange in Canada or the U.S., pooled and mutual funds. The Finance Committee shall be required approve any fund as eligible for investment.

The Investment Managers shall ensure the assets, excluding Restricted/Donor-Advised funds (III.C) are held in securities that can be liquidated quickly under normal market conditions.

Assets may not be invested in commodities, future contracts, options purchases, or short sales, without the specific consent of the Board. Contracting to sell securities not yet acquired to purchase other securities for purposes of speculating on developments or trends in the market. All mortgage investments must be secured using pooled funds. Borrowing for investment purposes is prohibited without the specific consent of the Board. To avoid concentration risk, no more than 15% of the total market value of the portfolio may be invested in commercial paper, bonds, debentures, or securities of any one issuer or related party, excluding Restricted funds (III.C).

Environmental, Social and Governance (“ESG”) factors or Socially Responsible Investing are sources of financial risk that prudent investors should consider when evaluating investments. Evaluating the risks and opportunities presented by ESG matters can be done in a manner which is consistent with the efficient investment of funds to achieve investment return objectives.

V. EXPECTED RISK

It should be expected that the rates of return on the Portfolio will vary from year to year, reflecting market and economic cycles. Nonetheless, these fluctuations will not deter the Investment Managers from making their best efforts to achieve their return objectives and thus assist the Board in achieving the return objectives of CMFSC.

A. Risk Tolerance

In this context, “risk” may be defined as the magnitude of changes (both increases and decreases), in the market value of a portfolio, i.e., the volatility over time. Clearly, it is the downward movements in the value of the portfolio that cause concern. The extent of any downward movement that can be accepted is a function of the Board's financial and emotional risk tolerance. Financial risk refers to the dollar or percentage amount of decline that can be accepted, given CMFSC's needs for capital preservation, income and inflation protection. Emotional risk refers to the extent of any decline that can be accepted given personality and previous experience with investments.

A decline of approximately 20% of the value of CMFSC's long-term fund (net of withdrawals) can be financially and emotionally tolerated, each year, if it reflects overall market returns.

B. Risk Management

The strategic asset mix establishes the risk and return characteristics of the total portfolio and also impacts investment-related costs. Adhering to strategic asset allocation targets helps CMFSC realize its investment objectives by imposing discipline on the investment decision-making process.

Beyond choosing the appropriate diversified asset mix, portfolio risk can be reduced substantially over the long term by being well diversified by industry group and geographically. Reducing company specific risk by taking a conservative approach to security selection, with quality being a key criterion. Quality includes choosing companies that exhibit strong balance sheets and free cash flow generation, have a record of growing earnings, and return on equity, and have competent management.

C. Time Horizon

Time Horizon has a direct effect on the amount of risk you can withstand, and on the return the portfolio can generate. As a rule, the longer the time horizon, the more risk can be taken in the portfolio and, therefore the higher the level of equity or private assets that can be included in the asset mix. Circumstances may change over time, so investment decisions and policies may change. Both the Operational Contingency Reserves and the Endowment investment classes can accept the short term volatility associated with a longer investment time horizon.

D. Liquidity

Liquidity refers to the amount of cash, cash equivalent or easily saleable (i.e. Publicly traded bonds or equities) securities held in a fund. The amount of liquidity is a function of needs in terms of upcoming cash requirements. If the time horizon is short, an illiquid asset may not be appropriate. Sufficient liquidity is important to allow future cash usage, if required. Both the Operational Contingency Reserves and the Endowment investment classes have relatively limited short term liquidity needs, allowing for investments in less liquid asset classes.

Appendix A: Endowment Fund Asset Allocation

Asset Allocation